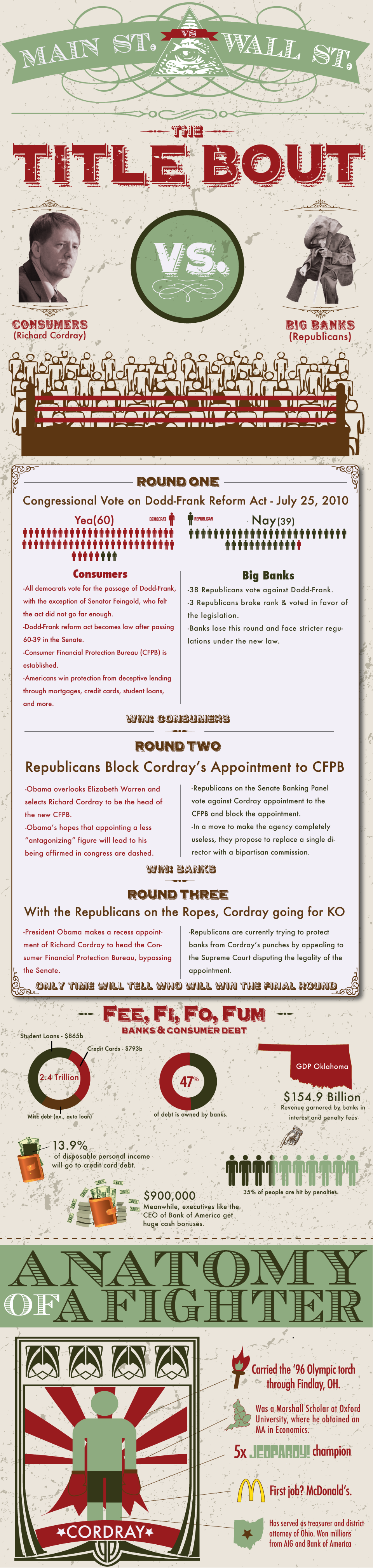

Ladies and gentleman welcome to tonight’s main event! In the balance hangs the future of our credit markets—folks, these are incredibly high stakes.

In the blue corner we have the Consumers, and in the red corner we have the Banks. Both sides are primed for a blockbuster collision that will be sure to add to the flame to the continuous political debates as this election season heats up. In the balance hangs the future of our credit markets—folks, these are incredibly high stakes.

Continue Reading Article ↓The Blow by Blow—A summary of the match surrounding the creation of the Consumer Financial Protection Bureau

Round 1: A loss for the banksThe democrats show some fancy footwork when all Democrats (except Senator Feingold) vote for the passage of Dodd-Frank, while 38 Republicans vote against. Three republicans break ranks and vote in favor. Republican Senator Scott Brown was the 60th vote. He cunningly negotiated on behalf of the banks to amend the legislation, eliminating language that would have made the banks pay the $19 Billion cost of enforcing the bills rules. American taxpayers will now foot the bill.

The Dodd-Frank reform Act passes, and the Consumer Financial Protection Agency is established. The Republicans take it on the chin and now banks face stricter regulations of lending practices.

Round 2: A neck to neck tieThis round goes punch for punch. Obama looks past Elizabeth Warren and selects Richard Cordray to be the head of the new Consumer Financial Protection Bureau. Obama’s hopes that appointing a less “antagonizing” figure will lead to his being affirmed in Congress are dashed.

The Republicans and banks throw a low blow: all ten Republicans on the Senate Banking Panel vote against Cordray's appointment to the CFPB. Republicans pledge to block any nominee over their opposition to the new agency's structure. In a move to make the agency completely useless, they propose to replace a single director with a bipartisan commission.

Round 3: A much needed win for the consumers!Cordray now has the banks and Republicans on the ropes and going for the 1-2 punch. President Obama makes a recess appointment of Richard Cordray to head the Consumer Financial Protection Bureau, bypassing the Senate.

It looks like big banking is losing this fight. Aside from holding up legislation and nominations, Senate Republicans have little they can do to retaliate against the recess appointment of Richard Cordray to head the CFPB. Republicans are currently trying to protect banks from Cordray’s punches by appealing to the Supreme Court disputing the legality of the appointment.

Round 4: At least my loan shark tells me when my vig doubles!

(What’s a vig you ask? That’s what a loan shark will call the interest he wants on a loan)

Time to get real. Much of the political coverage of the congressional antics and sparring often feel like reading the sports pages. However, unlike a boxing match, where you might stand to lose a $100 bucks in a friendly bet, the fate of billions of dollars in fees hang in the balance. Will they land in the pockets of consumers or in the endless pocket of greed held by big banks?

To really understand what all the fuss is about take a look at what fees the banks are battling over:

$1 Trillion is the amount of consumer debt (not including mortage debt) held by commercial banks in USA. That's nearly one half of the total consumer debt in America.

$154.9 Billion is what Banks earned from Credit Card Interest, Penalties & Fees in 2011.

$16 Billion is the amount banks claim they'll lose each year, after the swipe fees were cut in half by the Dodd-Frank legislation. These are fees merchants pay whenever you use a credit card.

$12 Billion is the loss in Credit Card Penalty Fees and Interest Rate hikes that banks claim they will lose each year due to Dodd-Frank. Why?

- The maximum fine for a late payment has been set by the federal reserve to $25. (unless the credit card issuer can prove the fee should be higher and discloses that fee to you BEFORE you get the credit card).

- Interest rates can no longer be hiked without warning. If a bank wants to raise your credit card interest rate, it must tell you in writing and can only charge you the new rate on future purchases, not any balance held prior to the hike. (which means they can’t tell you that your 12% interest rate on that balance your trying to pay off is now 29% just because you paid your bill late).

$38.5 Billion is what banks are expected to earn from 100 million Americans in checking account overdraft fees according to the financial times. Thes fees comprise 75% of service charges that banks rip out of millions of Americans each year. This cash cow is threatened by a new law that allows Americans to OPT-OUT of overdraft fees by telling their banks to “deny” payment for purchases where there are no funds. Sure you might be embarrassed at the grocery store when your debit card doesn't work, but you’d save $30-$100 in overdraft fees! The law gives you that OPTION, and banks hate it when you have a choice.

$865 Billion is the total student loan debt in the United States. Currently, student loans cannot be discharged in bankruptcy. Financial practices in this sector are a largely untouched treasure trove of fees that affects Americans in the middle class. This poor fellow’s life was nearly destroyed when after a serious Jet-Ski accident, his student loan debts ballooned from $270,000 to $435,000 in just 4 years due to Sallie Mae’s unscrupulous lending fees and penalties. You can bet banks don’t want Richard Cordray to start sniffing around their private student lending practices.

Since it’s inception in 2010, Dodd-Frank has helped Americans save billions on fees, penalties and insane interest rates. The Consumer Financial Protection Bureau is set to continue the trend of policing banks in their predatory lending practices that have been bleeding their customers of their hard-earned money with technicalities, fine print, and sneaky fees.

Double Jeopardy! “Who is Richard Cordray?”

With all that in the balance, here’s why we think that America the Purple should be united in Richard’s corner. His background and life story will tell us a lot about what kind of person he is:

- Do you want to super size that? Cordray’s first job was working at a McDonald's earning minimum wage. Do you know any Republicans that flipped burgers and flung french fries?

- I’ll take economics for $500 Mr. Trebek! Cordray is a 5 time undefeated champion of “Jeopardy” and a semifinalist of the “Tournament of Champions”. In 1987 his total winnings from the show was $45,303. He used most of the money to pay some of his college tuition and the rest to buy a used car. Can you imagine being a 5 time “Jeopardy” champion? The man is a genius!

- Did we mention he’s smart? He earned his masters degree in economics at Oxford University, and then went on to earn his Juris Doctor degree at the University of Chicago Law School. With those economic chops and legal training, he'll likely pack quite a punch when leveling the playing field for American consumers.

- Past Battle's Fought and Won! He’s got a proven track record. As attorney general of Ohio in 2009-2011, he filed a class-action lawsuit against Bank of America, arguing that it concealed serious weaknesses from shareholders, including billions of dollars in losses, when it asked them to vote on its acquisition of Merrill Lynch. He also secured a $725 million settlement from AIG for bid rigging.

Richard Cordray's stint as Ohio's attorney general shows that this isn't his first rodeo when it comes to fighting big banks and businesses. Imagine what he could do with the full power of the Consumer Financial Protection Bureau behind him?

According to Deputy Treasury Secretary, Neil Wolin, “The agency’s purpose is to “address unfair, deceptive, and abusive practices by payday lenders, private student loan providers, debt collectors, and other nonbank lenders, including certain mortgage originators and services.”

That means this burger flipping attorney general from Ohio will have a fighting chance at correcting all of the financial exploitation that has hit American consumers. From the fees you face from your bank, your credit cards, your student loans, and home mortgage provider.

Republicans often warn against class warfare, but their blind support of an unregulated and “wild-west” financial industry belies their commitment of protecting the ability of the few to profit on the many.

Richard Cordray will now fight toe-to-toe against unfair lending practices. We should all hope that he will float like a butterfly and sting like a bee. Otherwise, the financial industry that took down the global economy will have the green light to keep knocking us all out.